December 2022/January 2023 Kontos Kommentary

The following commentary is produced by Tom Kontos, Chief Economist, ADESA Auctions.

Summary

Average wholesale used vehicle prices in December were down modestly versus November, yielding the seventh monthly decline in a row and another double-digit year-over-year drop. However, the rate of decline tapered greatly in December, and prices rose solidly during the first weeks of January.

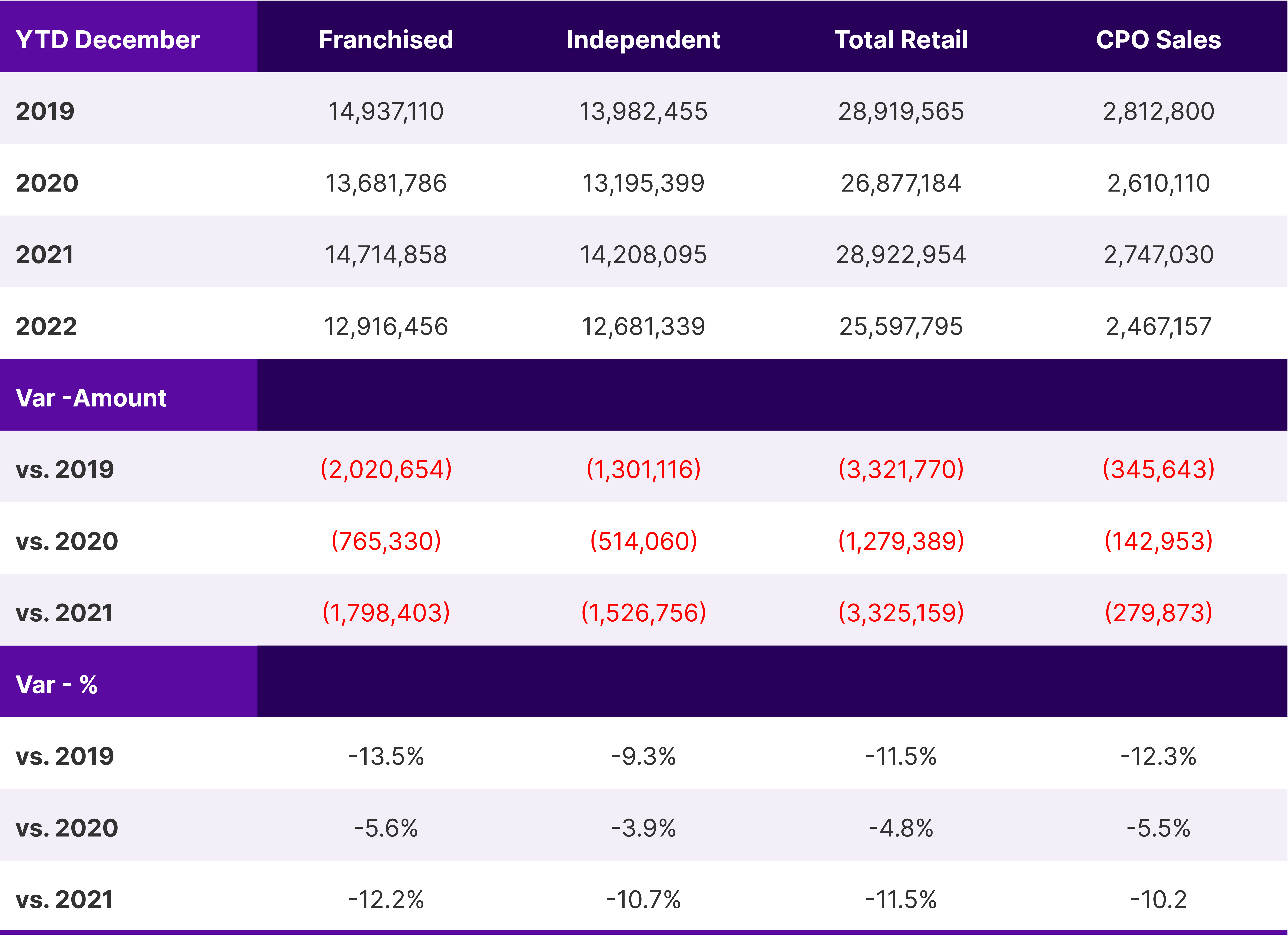

Retail used vehicle and certified pre-owned (CPO) sales improved in December; however, the full year ended down by double digits versus 2021 and pre-pandemic 2019.

Wholesale Market Trends*

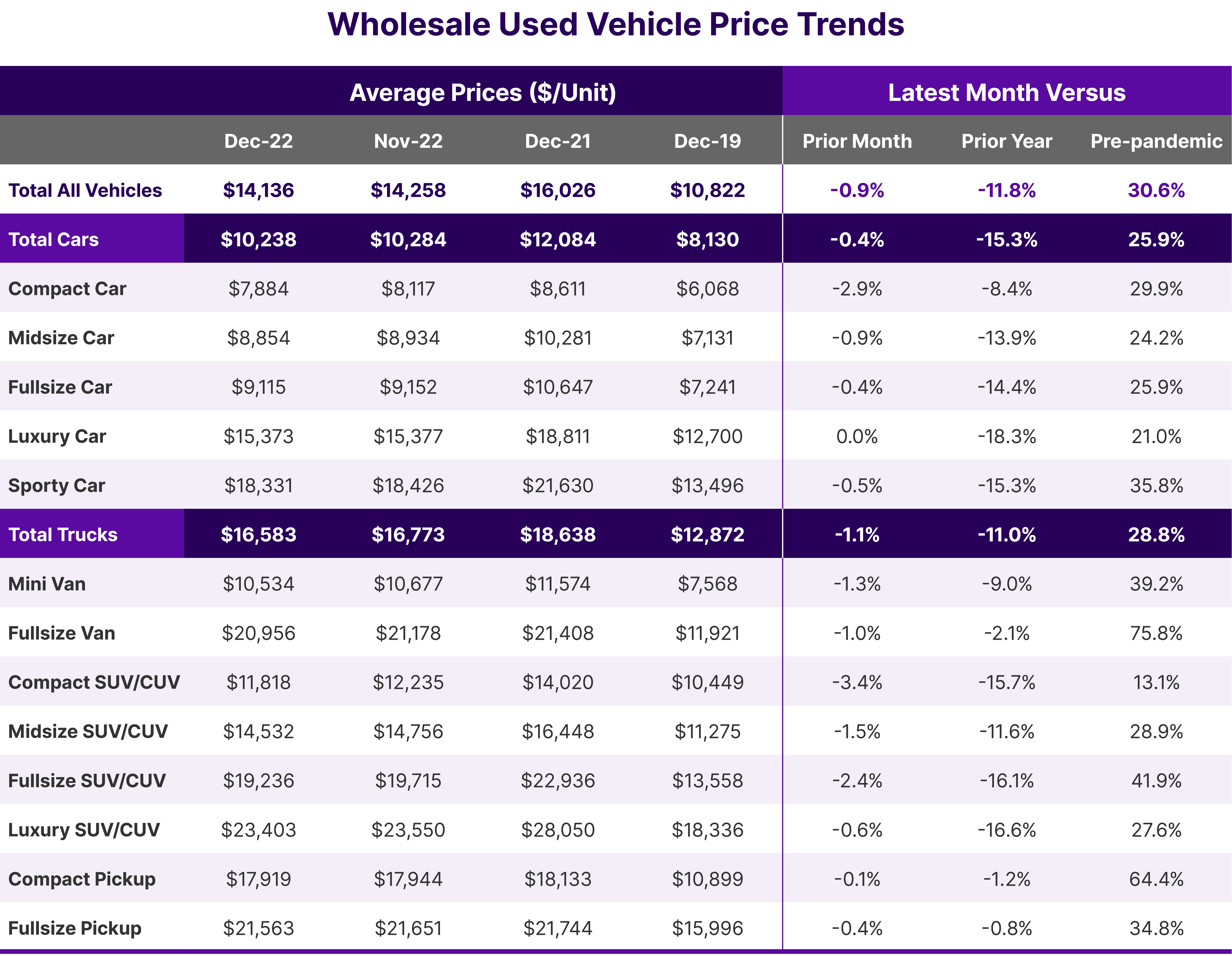

According to ADESA US Analytical Services’ monthly analysis of auction industry used vehicle prices by vehicle model class, wholesale prices in December averaged $14,136—down 0.9% compared to November, down 11.8% relative to December 2021, but still up 30.6% versus pre-pandemic/December 2019, as seen below. All model class segments showed average price declines for the month with the exception of luxury car prices, which were flat.

Average prices have increased so far in January and stood at $14,559 for the week ending January 15.

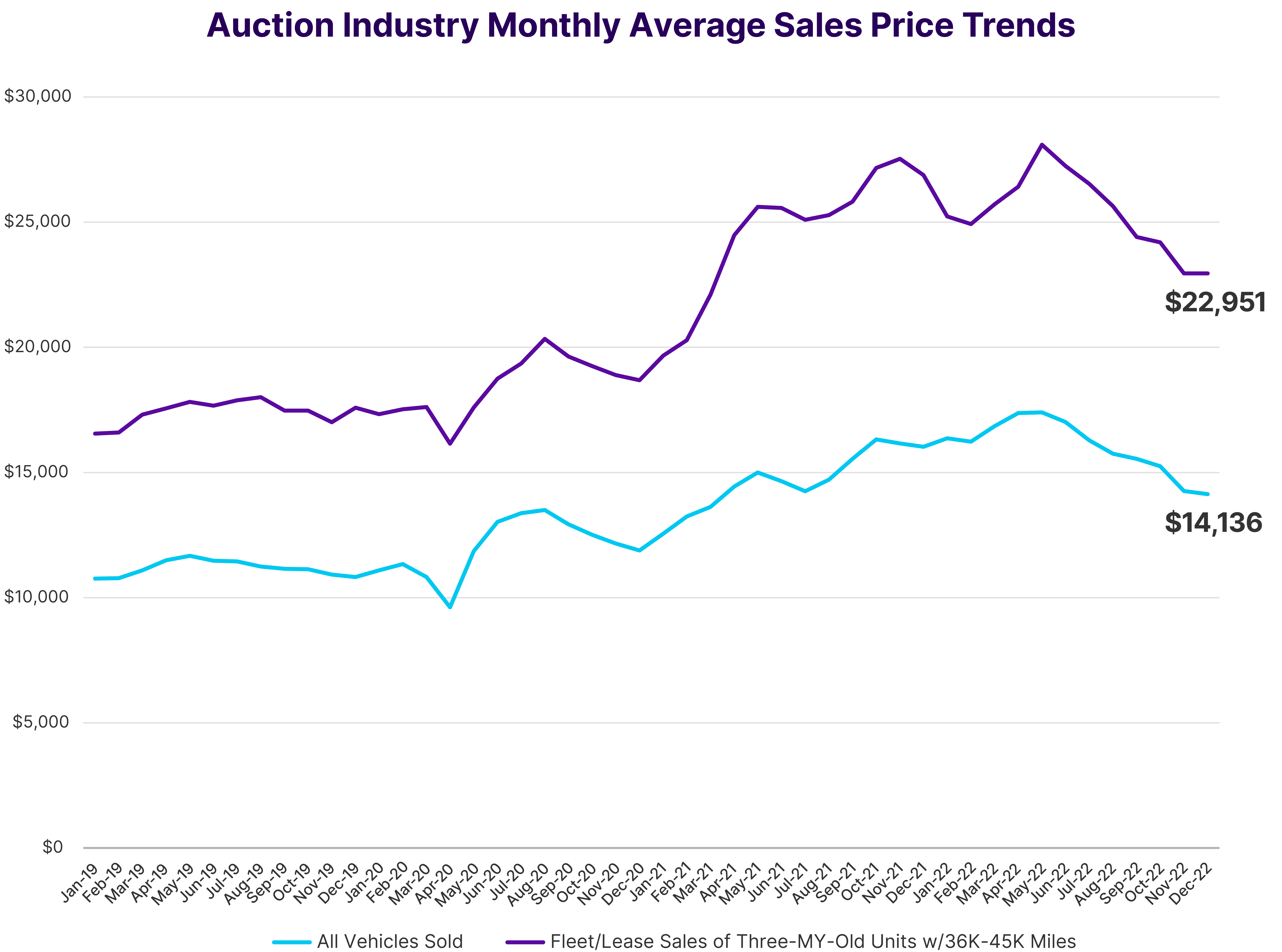

Further insights on wholesale price trends can be gained by holding constant for auction sale type, model-year age and mileage (the upper line in the following graph, which represents late-model units), as well as price trends for all vehicles sold (the lower line in the graph below). The rate of decline in average prices declined in December for both groups and was almost flat for late-model units.

A with historical data broken out by model class for the table and graph in this section has been provided with this report for your convenience in tracking these trends going forward.

Retail Market Trends

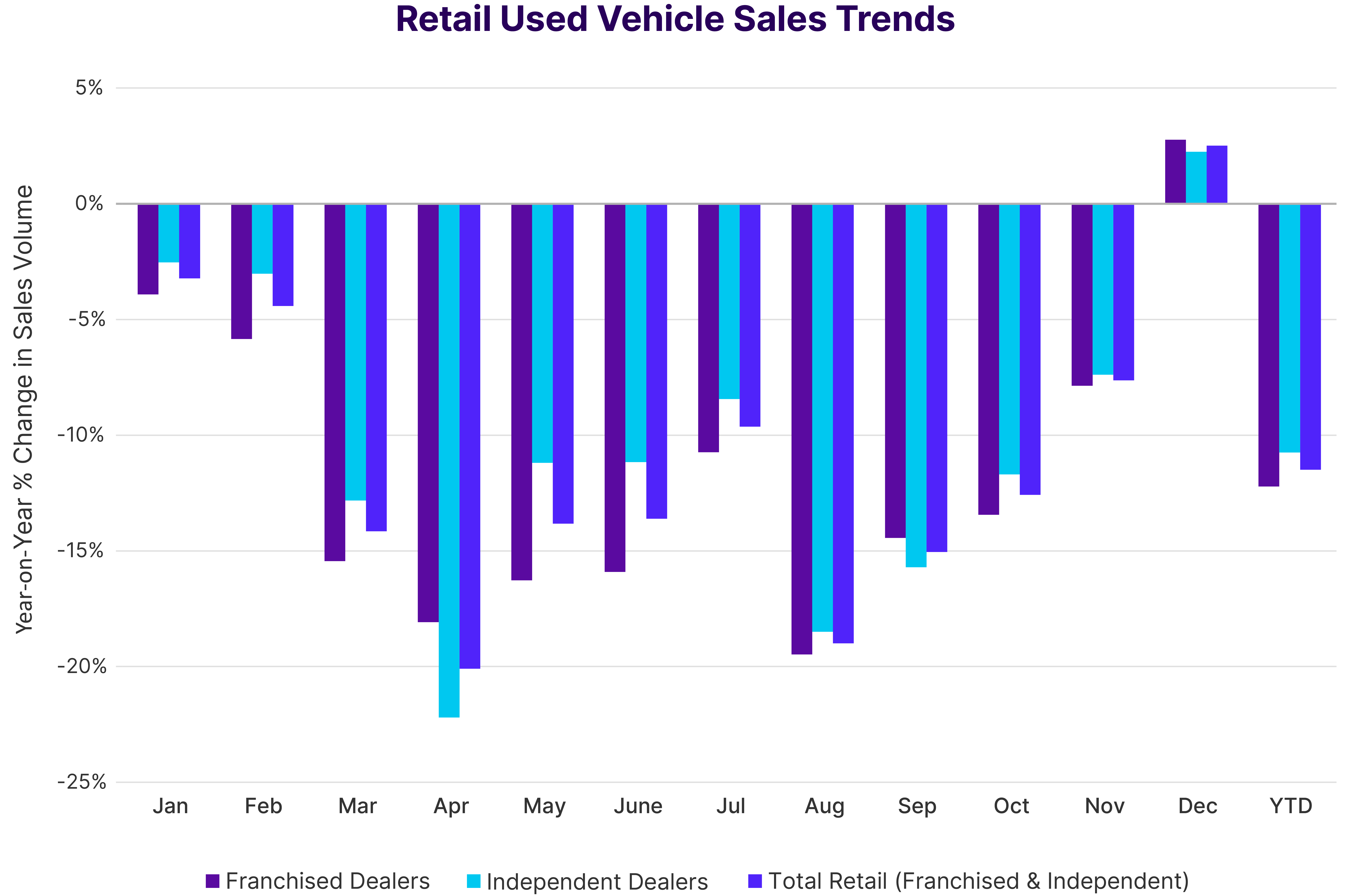

The following graph and table summarize data on retail used vehicle and CPO sales through December based on ADESA US Analytical Services’ analysis of data from NADA and Motor Intelligence, respectively.

Retail used vehicle and CPO sales were up both month-over-month and year-over-year in December but were still down on a full-year basis by double digits versus 2021 and pre-pandemic 2019.

Trendspotter

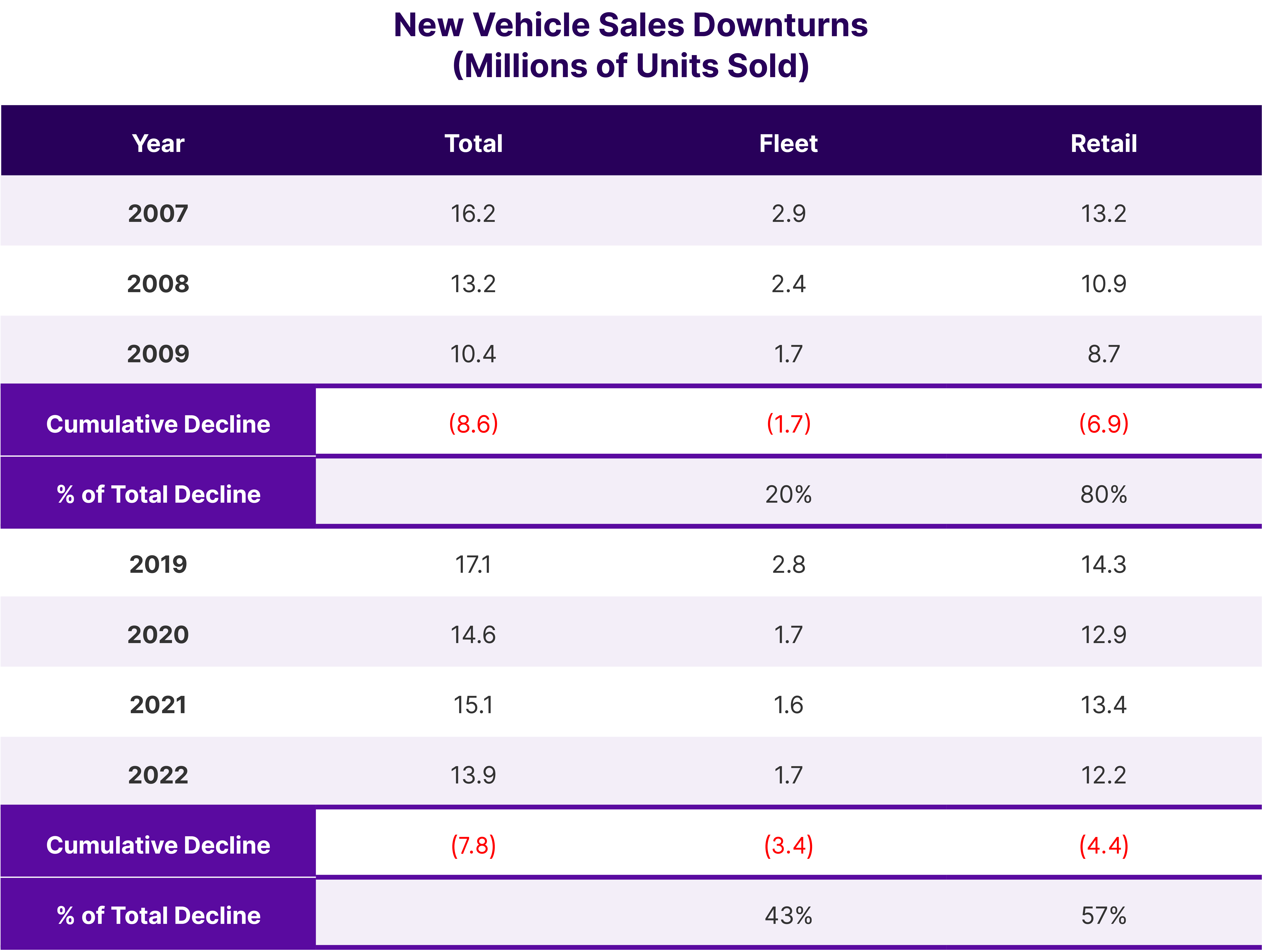

Since the pandemic, I have been doing a full-year comparison of recent new vehicle fleet and retail sales declines to those that occurred during The Great Recession. Now that I have full-year data for 2022, I’m able to update that analysis, as summarized in the following table:

Notice that compared to pre-pandemic 2019, new vehicle sales haven’t dropped as fast as they did during the ’08-’09 recession. Moreover, the losses this time have been concentrated in fleet sales—primarily rental fleets—not retail sales. This has ramifications for used vehicle supply. For example, rental fleet units are typically remarketed much sooner than retail units, so the auction industry has absorbed much of that loss already. Conversely, if new vehicle sales, especially rental fleet sales, start to increase, wholesale volumes could recover more quickly.

Of course, there are a lot of other “moving parts” in determining future used vehicle supply, but the fleet/retail composition of new vehicle sales is an important factor worth considering in that determination.

Disclaimer: The views and analysis provided herein relate to the vehicle remarketing industry as a whole and may not relate directly to ADESA US. The views and analysis are not the views of ADESA US, its management, its subsidiaries or its parent companies; and their accuracy is not warranted.

Forward-Looking Statements: The statements contained in this report and statements that ADESA US, its management, its subsidiaries or its parent companies may make orally in connection with this report that are not historical facts (including, but not limited to, expectations, estimates, assumptions and projections regarding the industry and business) may be forward-looking statements. Words such as “could,” “should,” “may,” “will,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “promises,” “likely to,” “outlook,” “potential,” “project” and similar expressions identify forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the results projected, expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include those matters disclosed in the “Risk Factors” identified in Carvana Co.’s Securities and Exchange Commission filings. Neither ADESA US nor its subsidiaries or parent companies undertakes any obligation to update any forward-looking statements.